Your Gateway to Global Business: UK Company Formation for Foreign Entrepreneurs

Dreaming of expanding your business horizons? The United Kingdom has long stood as a beacon for global trade and innovation, making it an incredibly attractive destination for foreign entrepreneurs looking to establish a new company. Its robust legal framework, stable economy, and international reputation offer a fantastic springboard for your venture. Let’s dive into why forming a company in the UK could be your next smart move and how to navigate the process with ease.

Why Choose the UK for Your Business?

The UK offers a plethora of advantages that make it a top choice for international businesses. From its strategic location to its business-friendly policies, there’s a lot to love.

Economic Stability and Global Access

One of the UK’s most appealing features is its strong, stable economy. This provides a secure environment for investment and growth. Furthermore, forming a company in the UK grants you access to a massive market, both domestically and internationally. Its strong trade links and international agreements make it a superb hub for global operations.

Business-Friendly Environment

The UK government is committed to fostering a supportive environment for businesses, regardless of their origin. The company formation process is streamlined and relatively quick, especially compared to many other countries. There are also various government initiatives and resources available to support new businesses, including access to funding and expert advice.

Prestigious Reputation and Credibility

Operating a company registered in the UK adds a significant layer of credibility and prestige to your business. This can be invaluable when dealing with international clients, partners, and investors. The ‘Made in UK’ or ‘Registered in UK’ tag often implies quality, reliability, and adherence to high standards, enhancing your global standing.

Key Requirements for Foreign Entrepreneurs

While the process is straightforward, there are a few essential requirements that foreign entrepreneurs need to be aware of when forming a company in the UK.

Directors and Shareholders

Good news! You don’t need to be a UK resident or citizen to be a director or shareholder of a UK company. A limited company requires at least one director and one shareholder, and these can be the same person. There are no nationality restrictions, making it highly accessible for foreign entrepreneurs.

Registered Office Address

Every UK limited company must have a registered office address located in the UK. This is where official communications from Companies House (the UK’s registrar of companies) and HMRC (Her Majesty’s Revenue and Customs) will be sent. If you don’t have a physical presence in the UK, many company formation agents offer a registered office service.

Company Secretary (Optional)

Since 2008, it’s no longer mandatory for private limited companies to appoint a company secretary, although you certainly can if you wish. Many businesses opt not to have one to simplify their administrative structure.

The Formation Process – Step-by-Step

Forming your UK company is surprisingly simple. Here’s a brief rundown of the key steps involved.

1. Choose Your Company Name

Your company name must be unique and not similar to any existing registered companies. You can check availability on the Companies House website. Make sure it’s memorable and relevant to your brand!

2. Prepare Your Documents

You’ll need to prepare your company’s Memorandum and Articles of Association. These are standard legal documents that outline the company’s constitution and rules. Most formation agents provide templates for these, simplifying the process significantly.

3. Submit Your Application to Companies House

This is where your company officially comes to life! You can submit your application online directly through Companies House or, more commonly and conveniently, through a company formation agent. They can handle all the paperwork and ensure everything is filed correctly and efficiently.

4. Open a Business Bank Account

Once your company is successfully registered, you’ll need to open a UK business bank account. This is crucial for managing your company’s finances legally and efficiently. While some traditional banks might require a physical presence, many modern challenger banks offer solutions for non-UK resident directors.

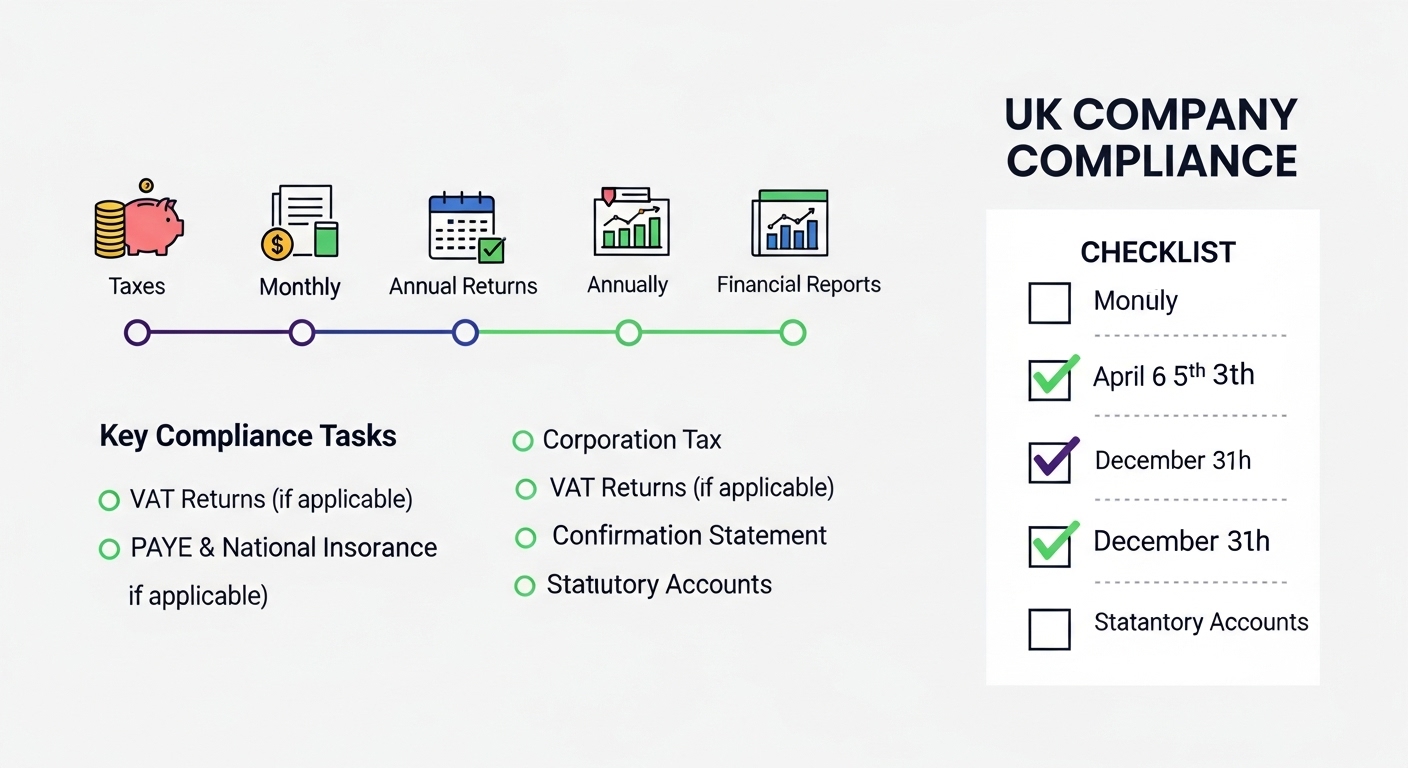

Post-Formation Considerations

Once your company is formed, it’s important to understand your ongoing responsibilities to ensure compliance.

Tax Obligations

Your UK company will be liable for Corporation Tax on its profits. You’ll need to register your company with HMRC and submit annual Corporation Tax returns. It’s advisable to seek professional advice to understand your specific tax obligations and how to best manage them.

Annual Filings

Every UK company must submit an annual confirmation statement to Companies House, confirming that the information on record is up to date. You’ll also need to prepare and file annual accounts, which will be publicly available.

Compliance

Staying compliant with UK company law is essential. This includes maintaining statutory registers (e.g., register of directors, shareholders), keeping proper accounting records, and adhering to data protection regulations. Engaging with a local accountant or legal professional can be incredibly beneficial in navigating these requirements.

Ready to Take the Leap?

Forming a company in the UK as a foreign entrepreneur is an accessible and rewarding venture. With a clear understanding of the requirements and processes, you can successfully establish your presence in one of the world’s leading economic hubs. The UK offers not just a place to register a business, but a vibrant ecosystem ripe with opportunities for growth and success. So, if you’re looking to elevate your global business presence, the UK might just be the perfect place to start your next chapter. Don’t hesitate to explore your options and turn your entrepreneurial dreams into a British reality!